Do millionaires and billionaires who run private investment firms really deserve to pay a lower tax rate on the slice of returns they generate? My answer – who cares whether they deserve to? The highest principle we should adhere to in determining public policy is that of maximizing utility, or the aggregate “net happiness” experienced by everyone in our society. Laws exist to protect rights so long as the protection of those rights is desirable, and those laws are “just” simply because they are desired by the many as a means to happiness.

Armed with this principle of maximizing happiness, let us examine the question of how carried interest should be treated by the tax code.

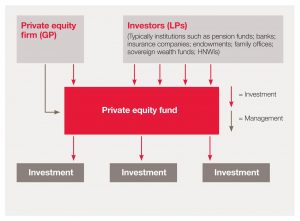

Private investment firms, which include private equity and venture capital funds, make long-term investments in businesses using capital raised from “limited partners,” hopefully allowing the businesses to grow and become more profitable so that years later the funds can sell their ownership in them and realize substantial profits. Top-level investment managers at these funds, also called “general partners,” typically both put some of their own capital on the line and make the majority of their salaries in the form of a share of their company’s profits called carried interest. Carried interest is essentially the share of their investments’ return (say, 20%) that fund managers get to keep in exchange for setting up deals and doing a ton of due diligence and research on target investments. The limited partners don’t do any work at all – they simply invest their capital with the fund managers in the hopes of growing their wealth.

The amount that each general partner takes home out of this amount of carried interest is currently taxed at the lower capital gains rate (maximum of 20%) rather than the higher income tax rate (maximum of nearly 40% at the federal level). Many argue that this constitutes an unfair loophole in the tax code. Additionally, the Treasury Department has estimated that taxing carried interest as income will raise about $1.8 billion in additional tax revenues each year, revenues that can be spent on public services. I argue, however, that doing so would violate the principle of maximizing utility.

Even if the tax code is inconsistent in the way it treats carried interest (which is itself debatable), such inconsistency is only worth remedying through legislation if the $1.8 billion increase in annual tax revenue would benefit society more than the resulting decrease in private investment (and potential outflow of competent fund managers) would harm it.

Private equity and venture capital funds are critically important to business development. When the infusion of capital into a business allows it to survive and expand, everyone is better off for it – a better business will be more valuable and provide its investors with a greater return while at the same time bringing new products and services to market and creating jobs. Additionally, specialized investment firms are often the only option for smaller or distressed companies who need to raise capital but cannot go to traditional lenders like banks because they’re deemed too risky. The capital gains tax rate is lower than the income tax rate to encourage productive investment and economic growth. Extending this tax break to general partners who risk both their own capital and their time and expertise in such ventures is critical to ensuring that the most skilled managers in the industry have the maximum incentive to work to identify potential “diamond in the rough” businesses.

$1.8 billion a year could pay for a lot of social services, services that would undoubtedly make a lot of people happier. Yet while it is difficult to quantify, the encouragement of successful capital allocation and meaningful risk-taking likely generates far more widespread and lasting happiness by fostering entrepreneurial innovation and creating new jobs, products, and markets.

Sources:

http://www.nytimes.com/2016/07/16/business/dealbook/the-carried-interest-loophole-what-loophole.html

http://www.ibtimes.com/what-carried-interest-tax-loophole-2100059